It is said to be optimistic is to assume things will work out. To be hopeful is to realize things can work out if you work at them.

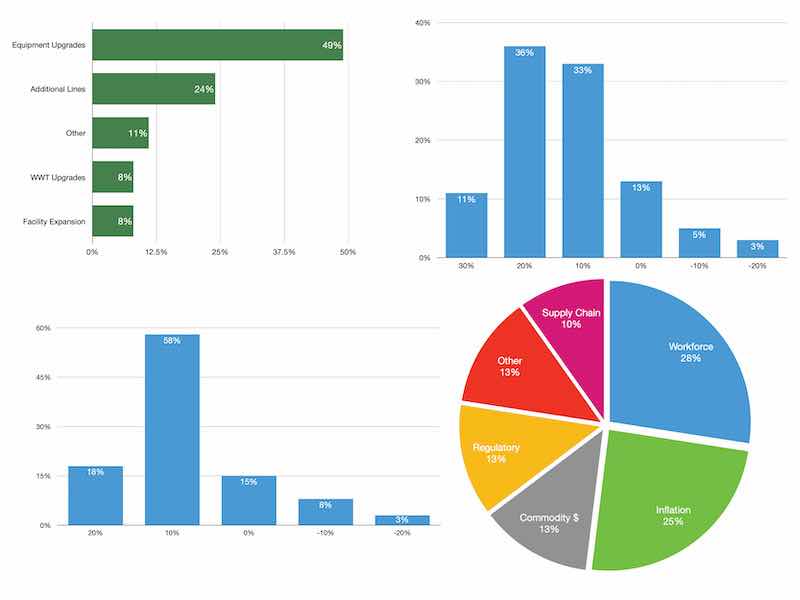

As we discovered when we surveyed the owners and managers of electroplating and anodizing operations recently, there is plenty of optimism about what 2023 will bring to the finishing industry.

But there are also a lot of realists who know that issues with labor, rising costs, supply chain, and impending economic concerns are all weighing heavily on owners’ and managers’ minds.

FinishingAndCoating.com surveyed several hundred owners and managers in January to get their thoughts on what the next several months might look like. We received a lot of sentiment that things might be on the upswing, but the financial issues belaboring the U.S. is also very much top-of-mind.

More than 75% of shop owners say they expect to see a 10% to 20% increase in sales in 2023 over 2022. And this comes after almost 80% of shop owners say they saw at least a 10% increase in sales from 2021.

But their optimism is tempered, and rightly so.

“I am highly concerned about pricing strategy as it seems my costs go up for paint and other supplies 10% every three months,” one owner told me. “I’m keeping my prices competitive is very hard with inflation.”

Others also weighed in with similar thoughts about 2023:

- “In the last quarter of 2022, we saw our sales contract about 15%. I expect the first quarter to be down about another 10% and hope that sales will begin to start rebounding in the second half.”

- “I believe a mild recession will continue through 2023 into very early 2024. We hope to stay similar to 2022 by increasing market share.”

- “I see a (hopefully slight) to moderate recession in 2023. Commodity and chemical prices have just gone sky high the last 18 months.”

- We also asked platers and anodizers to identify trends they see coming in 2023 and beyond:

- “Increased regulations and reduced volumes from some customers.”

- “Quick Turns dominate the landscape.”

- “Regulatory activism is crushing CA plating. So over-regulated that costs can be absorbed.”

- “Management of increased regulations.”

- “Lot sizes continue to be reduced.”

- “Customers are pushing back on any type of price increase.”

- “Expansion and contraction depend on the industry we are finishing for.”

- “Demand for finished aircraft parts is on the rise. Current build rates are slowly returning to 2018 and 2019 numbers.”

- “Some movement from the zinc plate to the zinc-nickel.”

- “Consolidation as our industry continues to shrink.”

Fortunately, many of these owners and managers have been down this road before, and they always seem to come out on the other side just as strong. We hope so again.

There is one thing to know about the finishing and coating industry: the people in it are just as tough and durable as the coatings they apply. The next several months won’t be easy, but tough people outlast tough times.

Tim Pennington is Editor-in-Chief of Finishing and Coating, and has covered the industry since 2010. He has traveled extensively throughout North America visiting shops and production facilities, and meeting those who work in the industry. Tim began his career in the newspaper industry, then wound itself between the sports field with the PGA Tour and marketing and communications firms, and finally back into the publishing world in the finishing and coating sector. If you want to reach Tim, just go

Tim Pennington is Editor-in-Chief of Finishing and Coating, and has covered the industry since 2010. He has traveled extensively throughout North America visiting shops and production facilities, and meeting those who work in the industry. Tim began his career in the newspaper industry, then wound itself between the sports field with the PGA Tour and marketing and communications firms, and finally back into the publishing world in the finishing and coating sector. If you want to reach Tim, just go