The National Association for Surface Finishing says in its 2022 Economic Impact Report on the U.S. surface finishing industry that there are more than 2,600 shops with an economic output of almost $11 billion.

The NASF 2022 Economic Impact Report found that automotive was the largest market segment at 45%.The NASF report — which accounted for plating, anodizing, and other chemical processes — says the shops are “mostly family-owned businesses” that directly employ over 71,000 people. It says those shops generated sales of over $10.7 billion, with an additional indirect economic impact of more than $10.9 billion.

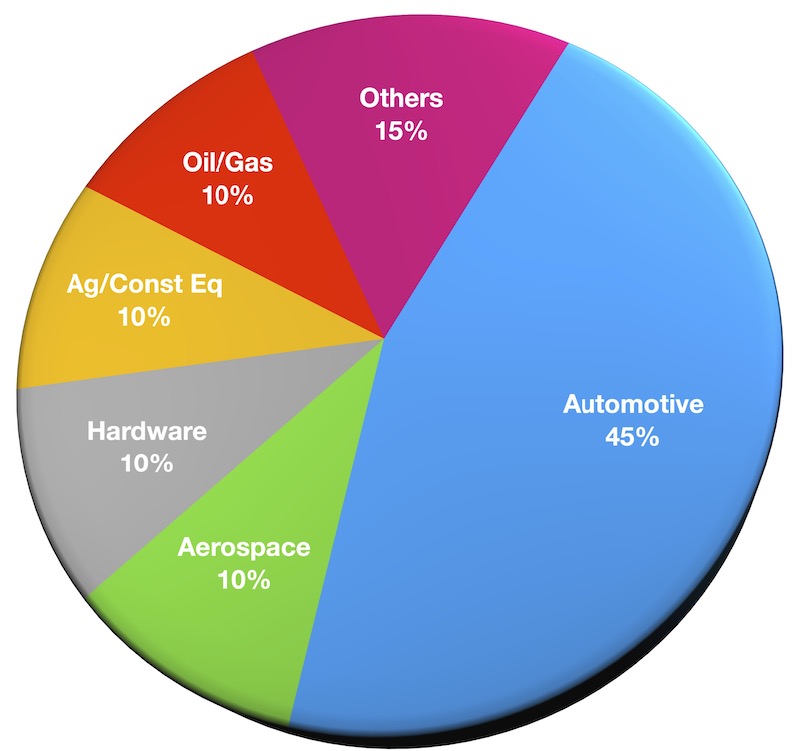

The NASF 2022 Economic Impact Report found that automotive was the largest market segment at 45%.The NASF report — which accounted for plating, anodizing, and other chemical processes — says the shops are “mostly family-owned businesses” that directly employ over 71,000 people. It says those shops generated sales of over $10.7 billion, with an additional indirect economic impact of more than $10.9 billion.

“Major industries reliant on surface technology include automotive (including the expanding electric vehicle market); defense, aerospace and shipbuilding; agriculture and construction; hardware and tools; and oil and gas exploration and production,” the NASF report says. “Other sectors include medical equipment, instruments, and implants; renewable energy technologies (e.g., solar, wind and geothermal; electronics (including semiconductor chip manufacturing and printed circuit boards); household appliances and fashion and luxury accessories.”

The 2022 Economic Impact Report found that automotive was the largest market segment at 45%, followed by 10% each for aerospace, hardware, agriculture and construction equipment, and oil and gas. Other markets combined to make up 15%.

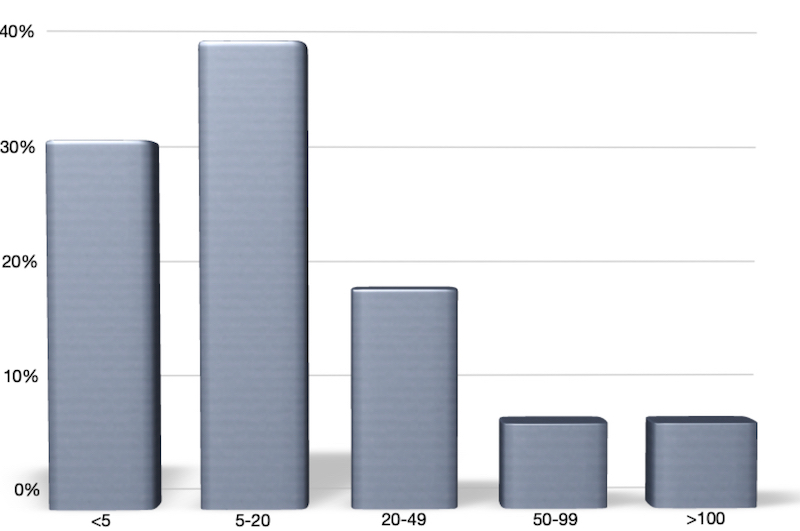

About 38% of all shops employ between 5-20 employees, the largest group in the survey.The report says the majority of surface finishing companies are small, family-owned businesses, with many being second or third- generation ownership. About 38% of all shops employ between 5-20 employees, the largest group in the survey. About 30% have less than five employees, with 18% having 20-49 employees. Only 7% of shops employ 50-99 and over 100 employees.

About 38% of all shops employ between 5-20 employees, the largest group in the survey.The report says the majority of surface finishing companies are small, family-owned businesses, with many being second or third- generation ownership. About 38% of all shops employ between 5-20 employees, the largest group in the survey. About 30% have less than five employees, with 18% having 20-49 employees. Only 7% of shops employ 50-99 and over 100 employees.

“The performance and health of the small “job shop” segment of the industry relies heavily on the expertise of its supplier community, which provides proprietary chemistries and metals, equipment, research, and advanced technical and environmental services,” the report states.

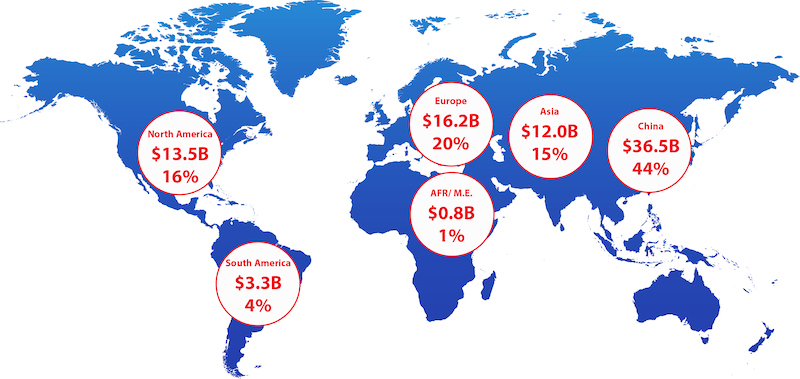

The global surface finishing market is just over $82 billion. China has the largest geographic output by region of the world’s surface finishing market at 44%, or roughly $36.5 billion. That is followed by Europe (20%, $16.2 billion), North America (16%, $13.5 billion), and Asia (excluding China) at 15% and $12 billion.

The NASF 2022 Economic Impact Report says the estimated 2,600 shops in the U.S. has dropped by almost 350 since 2012, or almost 12%. Since 2000, the NASF says about 1,900 finishing operations have closed in the U.S.

“This decline is likely to continue for the foreseeable future as more consolidation in the industry occurs,” the NASF report says. “Consolidation is a trend that has been underway for some time in the surface finishing industry.”

“This decline is likely to continue for the foreseeable future as more consolidation in the industry occurs,” the NASF report says. “Consolidation is a trend that has been underway for some time in the surface finishing industry.”

Of all processes, electroplating is by far the largest at 40%, with anodizing (15%), electroless nickel (10%), and phosphating (10%) following. Vapor deposition, chemical passivation, and electropolishing all came in at 5%.

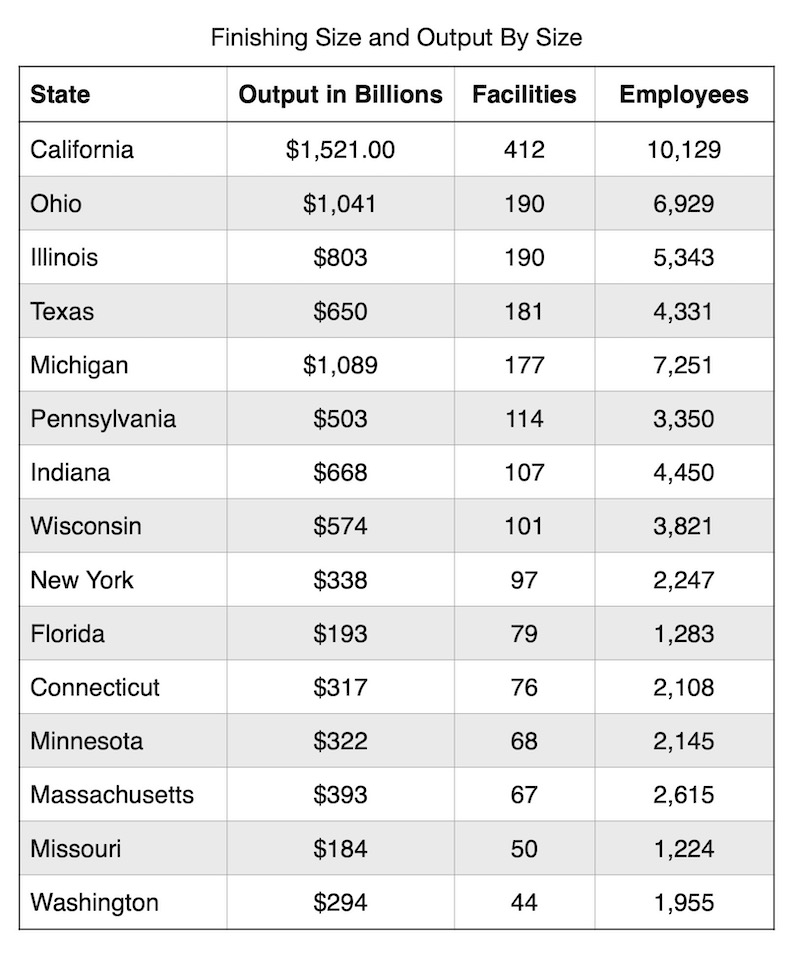

California has the largest number of surface finishing operations with 412, followed by Illinois and Ohio with 190 each, Texas with 181, Michigan with 177, Pennsylvania with 114, Indiana with 107, and Wisconsin with 101.

Much of the NASF 2022 Economic Impact Report came from data from the U.S. Census Bureau and information from consultant Orr & Boss. A complete report is available from the NASF. Visit www.nasf.org