For most finishers, 2025 should mean better revenue than the year before, but issues such as labor, supplier consolidation, and the economy are still causing concern.

A look at how shops increased or decreased its sales in 2024 from the previous year.That is the result of an industry survey conducted by www.FinishingAndCoating.com in December of finishing and coating operations in North America. The owners and managers of electroplating, anodizing, metal finishing, and liquid and powder coating shops were surveyed, and more than 420+ completed substantial parts of the survey. Only those shops who took the survey and supplied their email will receive the full industry survey report.

A look at how shops increased or decreased its sales in 2024 from the previous year.That is the result of an industry survey conducted by www.FinishingAndCoating.com in December of finishing and coating operations in North America. The owners and managers of electroplating, anodizing, metal finishing, and liquid and powder coating shops were surveyed, and more than 420+ completed substantial parts of the survey. Only those shops who took the survey and supplied their email will receive the full industry survey report.

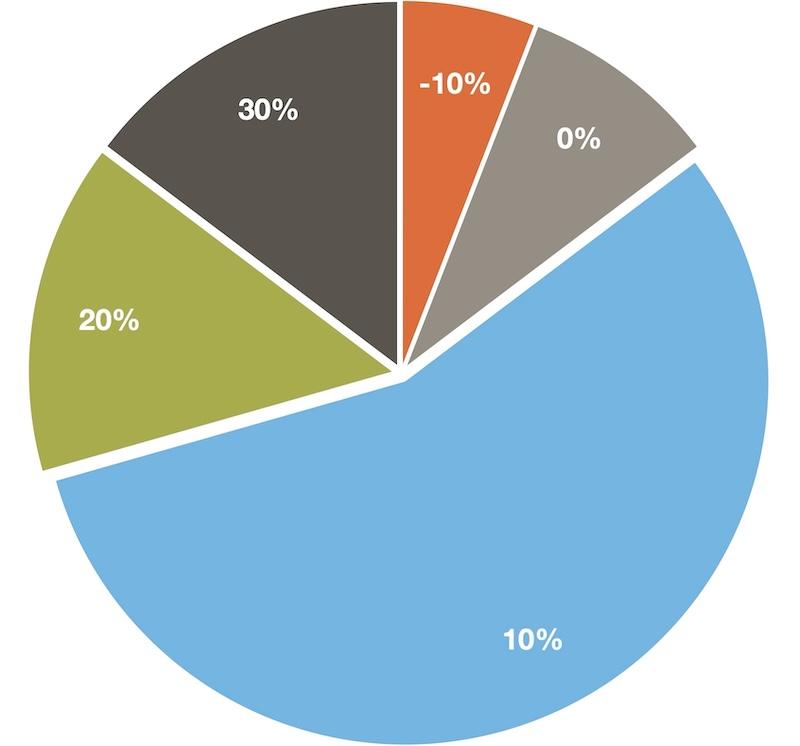

More than 86% of finishing shops say 2025 will be a better year than 2024 for their company. Only 6% forecast sales to be less than last year, and roughly 9% expect their sales to be flat in 2025.

Possible Improved Economy Raising Hopes

Overall, the outlook is good as the U.S. heads into a new administration and possibly improved economic forecasts.

“It will be a return to normalcy,” one electroplater said of the optimism for 2025. “A better economy should lead to more opportunities to consider resuming programs placed on hold.”

Around 56% of the shops expect at least a 10% increase in sales compared to 2024. 15% forecast a 20% or higher growth in 2025, and another 15% say they could reach at least 30%.

One electroplating owner says the backlog and projects released during the first half of 2025 will contribute to the continued increase in everyday work.

“The increase was not necessarily related to new sales through new customers. It was attributable to our existing customers recovering from a bad 2023 and, thankfully, starting to get back to their historical sales levels in the past.”

“There are a lot of new projects starting for us in 2025 for aerospace, automotive, and energy industries,” he says.

Another finisher says, “Optimism is way up” as 2025 takes hold.

“The last administration was not friendly to manufacturing,” he says.

Most Shops Struggled in 2024

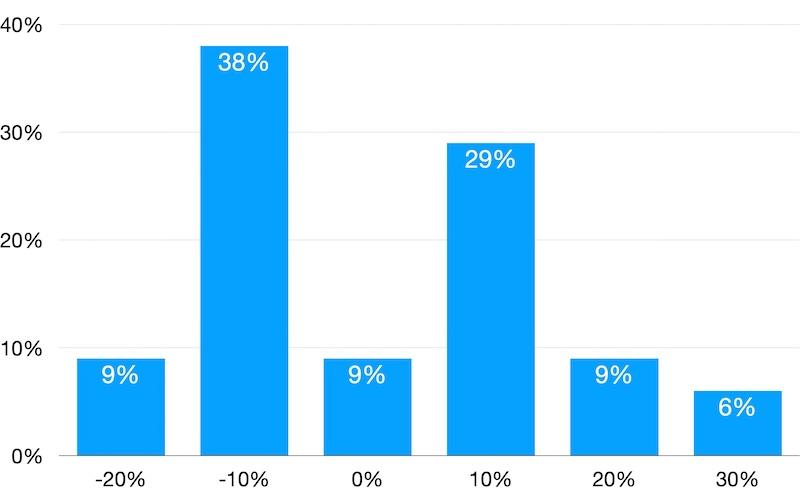

How shops are forcasting either a sales increase or decrease in 2025 compared to 2024.Looking back at 2024, almost 38%—the largest percentage of the category—say their sales declined by at least 10% compared to 2023. About 9% say they saw a 20% drop in business from a year earlier, and another 9% say their sales were flat from 2023.

How shops are forcasting either a sales increase or decrease in 2025 compared to 2024.Looking back at 2024, almost 38%—the largest percentage of the category—say their sales declined by at least 10% compared to 2023. About 9% say they saw a 20% drop in business from a year earlier, and another 9% say their sales were flat from 2023.

Roughly 29% of shops said their sales increased by 10% or less in 2024, while 9% saw at least a 20% revenue increase. About 6% said they had a 30% or more increase in sales from 2023.

However, some finishers say that their rebound in 2024 was mostly due to a bad year in 2023.

“The increase was not necessarily related to new sales through new customers,” one finishing shop manager said. “It was attributable to our existing customers recovering from a bad 2023 and, thankfully, starting to get back to their historical sales levels in the past.”

Others say 2024 was a struggle, as a poor business climate caused many long-time customers to reduce production and inventory.

“The volume of our top three customers was down 20% in the first half of the year,” one finisher says of 2024. “The second half was busier, but we could not recover.”

Capital Expenditures on the Rise

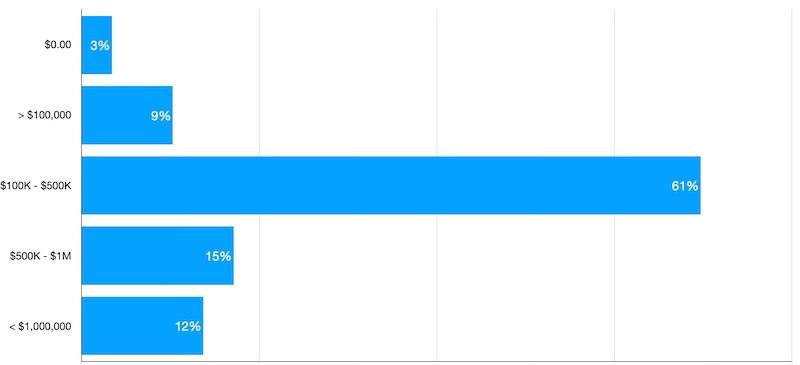

Regarding budgeting for 2025, around 61% report they have budgeted between $100,000 and $500,000 in capital expense improvements. About 15% say they are budgeting between $500,000 and $1 million in 2025, and 12% say they have more than $1 million in improvements slated for this year.

Just 9% say they have only budgeted less than $100,000 for capital improvements in 2025, and only 3% say they have no budget for improvements this year.

“We are updating our existing equipment, which is getting old,” a shop general manager says. “We are going to be using automation to help with the labor shortage, and we are having spares for almost everything that can go down because it is still hard to get equipment.”

“No matter which chemical or specialty plating chemistry supplier we use, the overall level of technical support seems to be diminishing. Far too many technical reps who have been around for years are retiring, and no one is filling their roles.”

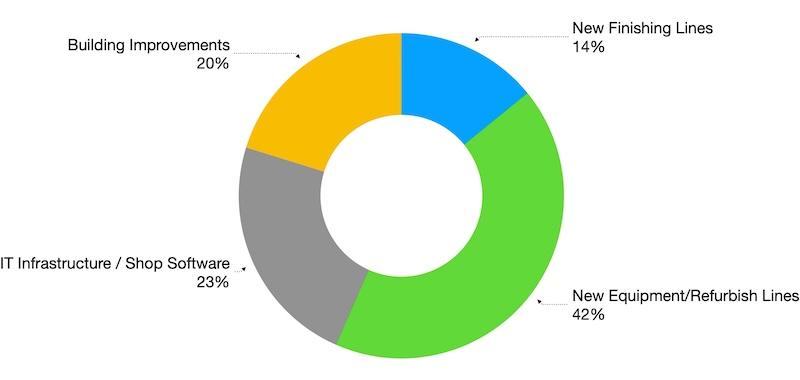

Of the projects the shops are budgeting for, more than 42% report they are planning to add new equipment or spend money on refurbishing the ones they have. About 23% say they are budgeting for new informational technology systems and automation software for their shops.

Overall, 20% of respondents say they will spend the bulk of their capital expenses on building improvements, and 14% say they have budgeted for new finishing lines to be added to their existing system.

“Reinvesting into the business is key to efficiency, longevity, and sustainability,” says one shop owner. “Our capital expenditures are thought out and planned wisely to stay ahead of potential issues and increase capabilities and efficiency.”

How much shops have budgeted for capital expenses in 2025.

How much shops have budgeted for capital expenses in 2025.

What shops plan to spend their capital expenditures on in 2025?

What shops plan to spend their capital expenditures on in 2025?

Labor, Regulations, and Supplier Consolidation Still a Big Issue Facing Finishers

Hiring, training, and retaining employees remain major issues for most finishing and coating operations, as they have been in previous years.

“The lack of skilled labor is a big problem,” says the GM of an anodizing shop. Another adds, “Finding qualified personnel is an issue as our workloads increase.”

Shop owners and managers are also concerned about the increasing number of new regulations for the finishing industry. As existing rules become tighter, especially those regarding wastewater and air quality, new regulations may be even more difficult for some shops to adhere to and pay for.

“If some of the proposed regulations aren't reviewed better for relevance and fairness, it will hurt tremendously,” a shop owner says.

“Due to this loss of knowledge, a lower skill level when entering the workplace, and lack of education and training, we rely more on suppliers to fix our problems.”

In addition, a growing trend that worries many shops is the continued consolidation of large suppliers in the finishing industry, including chemical and equipment suppliers. Shop owners and managers bemoan a lack of competition, which hurts them in terms of pricing, and managers say they are noticing a change in the amount of support they are getting from some suppliers after they have made acquisitions.

“No matter which chemical or specialty plating chemistry supplier we use, the overall level of technical support seems to be diminishing,” a shop president says. “Far too many technical reps who have been around for years are retiring, and no one is filling their roles. So, our supply chain’s traditional technical assistance and support level is trending in the wrong direction.”

Another shop president said bluntly: “There is too much consolidation of chemical companies.”

As finishing and coating operations find it harder to hire new staff to replace seasoned employees who leave, it is even more important for shops to seek technical assistance from their suppliers.

“Due to this loss of knowledge, a lower skill level when entering the workplace, and lack of education and training, we rely more on suppliers to fix our problems,” a shop manager says.