Finishing and coating shops say the COVID-19 pandemic and the ensuring supply chain issues have put a major dent into their operations, but many say this may be the year that things change for the better.

A survey by www.FinishingAndCoating.com of over 200 shops in the electroplating, anodizing, liquid, and powder coating industries found that shops were hit hard by the pandemic and the shortage in supplies, but their business profits remained steady and grew in 2021 compared to 2020.

“Most customers are aware of the delays and are becoming more understanding. Not all but most,” says one plater. “Some will shop elsewhere. Quick turnaround time is still a factor.”

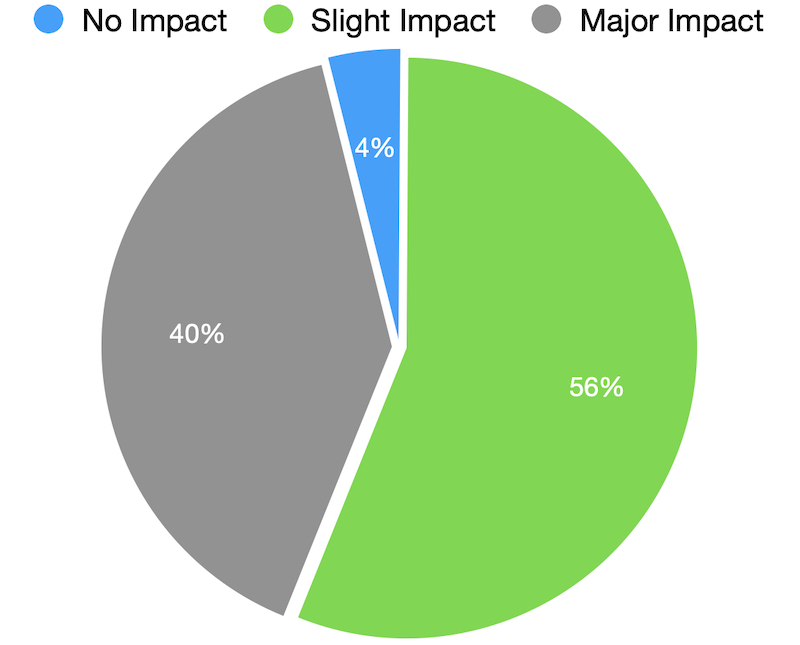

Majority Have Felt a “Slight Impact”

Most shops they have felt a "slight" impact on their overall business in the past 24 months.Of all finishing shops surveyed, 54% say that COVID-19 issues have had a “slight impact” on their business operations, with 41% reporting a “major impact” on operations. Of those shops who say they have had some impact, almost 35% report the situation is getting “somewhat better” while 33% say the situation is worsening, especially as the new omicron variant spread throughout North Americas.

Most shops they have felt a "slight" impact on their overall business in the past 24 months.Of all finishing shops surveyed, 54% say that COVID-19 issues have had a “slight impact” on their business operations, with 41% reporting a “major impact” on operations. Of those shops who say they have had some impact, almost 35% report the situation is getting “somewhat better” while 33% say the situation is worsening, especially as the new omicron variant spread throughout North Americas.

More than 77% of shops say the related supply chain issues have had a major effect on their finishing operations. Nearly 49% of all shops who say they have been affected say getting chemicals in their facility on time has been the biggest issue, with another 47% saying that ancillary supplies like masking and other needed items have been delayed by supply chain delays.

“We have substituted items with less than ideal products,” a plater says. “At times, this slows production. At the first hit of shutdowns, we were almost at a standstill when needing parts for repairs for projects and equipment. We had just started work on starting a new finish, and costs to set that up became more expensive. We have seen an improvement in supply needs faster shipping; however, sourcing the materials we prefer has still proven to be difficult.”

About Half say Equipment Ordering is Delayed

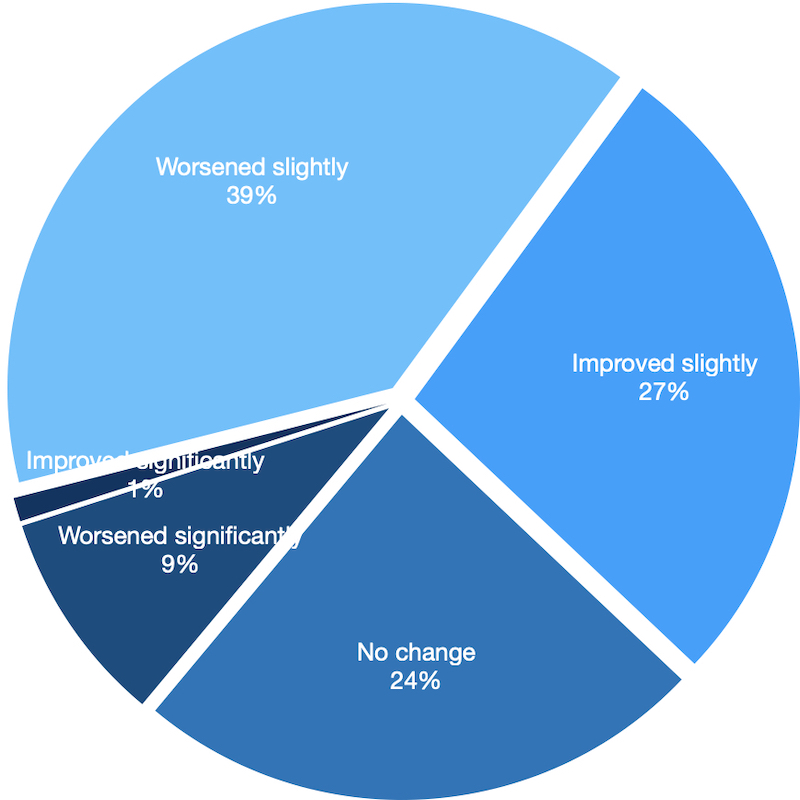

Shops say things have "worsened slightly" over the past three months on relation to COVID and supply chain issues.More than 47% say that they have not been able to order equipment because of supply chain delays or that the equipment is taking longer than expected. Less than 5% of respondents report that they can not get coating application supplies on time — like liquid and powder coatings and electroplating finishes.

Shops say things have "worsened slightly" over the past three months on relation to COVID and supply chain issues.More than 47% say that they have not been able to order equipment because of supply chain delays or that the equipment is taking longer than expected. Less than 5% of respondents report that they can not get coating application supplies on time — like liquid and powder coatings and electroplating finishes.

Almost 60% of shops say they agree or strongly agree that supply chain issues have limited their operations, while just about the same percentage say the biggest culprit in the supply chain delays is not getting enough information about when the supplies will actually arrive at their plant.

Nearly 39% of shops say the supply chain crunch worsened slightly in the 4Q of 2021 and the beginning of 2021, while 27% reported they saw a slight improvement overall in the supply chain delays.

As for year-over-year changes from 2020 when the pandemic first began to the end of 2021, more than 32% of shops their business improved slightly from 5% to 10% from one year to the next, and 27% reported business gained between 10% and 25% in 2021 from 2020. An additional 17% say their operations jumped as high as 50% from one year to the next.

Despite the delays in getting equipment, more than 75% of shops say they plan to continue with large capital investments in their operation in 2022, with less than 10% saying they will limit their expansion projects until after the supply chain issues clear up.

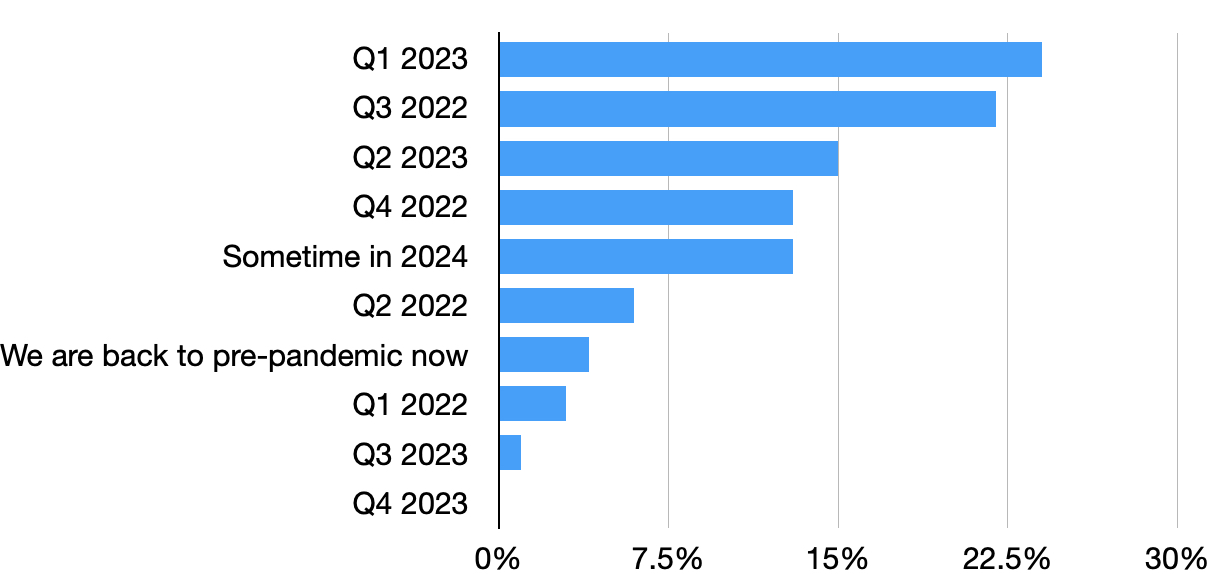

Q32022 or Q12023 Seem to be Normalcy Targets

Most shops feel that Q3 of 2022 or Q1 of 2023 will be the time when operations and overall business will return to pre-pandemic levels. The highest guess — at around 23% — reported that Q1 2023 is when things will return to normal levels, with just over 22% saying they expect things to start getting better in Q3 of 2022. Just under 4% say they are now back to the operational levels that were at before the pandemic hit in early 2020.

Shops were asked to predict when they believe business operations will return to "normalcy."

Shops were asked to predict when they believe business operations will return to "normalcy."

“The pandemic had a drastic effect on our business,” a finisher says. “Both internal and external factors were the culprit. Internal factors were employee absence due to Covid-19 and external factors affecting our customers and the supply chain. We are seeing some signs of recovery on the customer side, but supply chain issues will carry on for some time.”

In general, about 68% of all shops say the continued uncertainty of what is happening to end the COVID-19 pandemic and the ongoing supply chain issues will have a negative effect on their facility’s bottom line by the end of 2022.

As for staffing, more than 55% say they would like to hire between 1 and 5 employees now to get to a comfortable level, with about 20% saying they could hire as many as 10 people if they could find workers. More than 25% of respondents say they need 10 or more people to add to their workforce, with 10% of those saying they have an opening for more than 20 employees at their shop.

“I’ve had to increase wages drastically to retain employees,” one finisher says. “I can’t find new employees, even with online and local advertisement.”

To get a copy of this full survey and study, please contact Tim Pennington, Editor-in-Chief at tp@FinishingAndCoating.com