Suppliers to the finishing and coating industries say supply chain disruptions have slowed some raw materials from getting to shops, but those channels should be opening up sooner rather than later.

Emilio PedralEmilio Pedral, Vice President of Global Marketing at Macdermid Enthone Industrial Solutions, says they are leveraging their global supply chain teams and systems to meet the demands of their customers for chemistry.

Emilio PedralEmilio Pedral, Vice President of Global Marketing at Macdermid Enthone Industrial Solutions, says they are leveraging their global supply chain teams and systems to meet the demands of their customers for chemistry.

“We have also changed our protocols of planning and implemented regular reviews of critically available raw materials,” Pedral says. “None of this prevented the need of increasing our cost and several materials, including those of indirect goods. Packaging and other indirect supplies were severely affected.”

A survey by www.FinishingAndCoating.com of over 200 shops in the electroplating, anodizing, liquid, and powder coating industries found that shops were hit hard by the pandemic and the shortage in supplies, but their business profits remained steady and grew in 2021 compared to 2021.

Beginning to Automate Processes

Fiona Levin SmithIFS Coatings Vice President Marketing and Specification Fiona Levin says their priority throughout the pandemic and ensuing supply chain issues has always been the safety of their team and our customers.

Fiona Levin SmithIFS Coatings Vice President Marketing and Specification Fiona Levin says their priority throughout the pandemic and ensuing supply chain issues has always been the safety of their team and our customers.

“We are automating where possible, running additional shifts, have been robustly managing our raw material supply forecasting, and negotiating transportation,” Levin says. “All while not losing sight of our long terms goals. For example, we’re constructing a new building for significant expansion in Texas.”

Matt Kreiner, Product Business Development Manager for Coatings Analysis Products for Hitachi High-Tech Analytical Science, says Hitachi has global and regional supply chain teams that monitor their inventory levels, compare that to the forecasted demand, and communicate with suppliers to ensure parts and components are received in time for customers, both for new shipments and to maintain installed equipment.

Matt Kreiner“A couple of years ago, a surprise component shortage or obsolescence could have forced us to scramble to find a solution to maintain continuity,” Kreiner says. “However, managing this situation with speed, agility, and communication has allowed us to keep moving forward despite challenging external circumstances.”

Matt Kreiner“A couple of years ago, a surprise component shortage or obsolescence could have forced us to scramble to find a solution to maintain continuity,” Kreiner says. “However, managing this situation with speed, agility, and communication has allowed us to keep moving forward despite challenging external circumstances.”

Finishers were asked what supply chain issues they were having.

Finishers were asked what supply chain issues they were having.

Reducing Impacts Where They Can Be

Matthew PankowMatthew Pankow, Global Sales and Marketing Manager at distributor Plating International, says they increased inventory, added an additional warehouse, purchased our own trucks, hired additional drivers, and contracted an independent warehouse.

Matthew PankowMatthew Pankow, Global Sales and Marketing Manager at distributor Plating International, says they increased inventory, added an additional warehouse, purchased our own trucks, hired additional drivers, and contracted an independent warehouse.

“All of this was to ensure our customers aren’t impacted by the most recent supply chain issues,” Pankow says.

At Miles Chemical, a chemical and supply distribution company based in Southern California, Vice President Sales and Marketing Dan Zinman says they have been working with customers on anticipated usage requirements and integrating with lead times, stocking agreements to dedicate stock in our warehouse at an established price, providing pricing outlook as best as they can so that customer know what the future holds, and offering potential alternatives for some chemicals that are out of stock.

Dan Zinman“There is a Beatles song with the lyrics ‘Got to admit it’s getting better; Cant get much worse,’” Zinman says. “I wish that was the case. Depending on the commodity, pricing continues to rise.”

Dan Zinman“There is a Beatles song with the lyrics ‘Got to admit it’s getting better; Cant get much worse,’” Zinman says. “I wish that was the case. Depending on the commodity, pricing continues to rise.”

When it comes to servicing their customers, Pedral says MEIS is planning, and analysis of their markets has been instrumental. They have also increased their communications efforts with customers to understand trends and anticipate their usage.

“We deployed online and virtual support, including the deployment of 83 webinars in the first year of the pandemic,” Pderal says. “30 of them were in Spanish, reaching over 10,000 customers interested in taking advantage of the pandemic to learn and improve their skills.”

Deliveries are Improving Slowly But Surely

Pedral says supply chain issues have improved slowly, and — depending on the product, material, and geography — the issue has found different relief levels.

“We don’t expect this to reasonably resolve until close to Q4 2022,” he says. “At the moment, planning is our best strategy.”

Carter BurninghamCarter Burningham, Director of Corporate Supply Chain at Hubbard-Hall, says the supply chain challenges are improving in some raw material challenges while also improving in others.

Carter BurninghamCarter Burningham, Director of Corporate Supply Chain at Hubbard-Hall, says the supply chain challenges are improving in some raw material challenges while also improving in others.

“It really depends on the product category,” Burningham says. “Overall, we’ve seen things plateau over the past three months.”

Jordan Rose, Hitachi High-Tech Analytical Science’s Operations Manager– Americas, says the overall situation is slowly trending positive.

“We see that as some components and parts are becoming more readily available, others start to have longer lead times,” Rose says.

Pankow says the supply chain issues have actually gotten worse.

“The cost of both international and domestic freight has gone up likely due to the U.S. and Chinese holidays,” he says.

Some Raw Material Prices Increase

Levin says IFS Coatings has seen raw material prices increase significantly over the last two years, and the last three months have been no different, with some resins, in particular, seeing continuing increases.

“We are continuing to see shortages and delays in materials, either related to covid or transportation,” she says.

The COVID-19 pandemic has affected many supply operations in different ways. Burningham says the Hubbard-Hall operations team has learned how to adapt to the many challenges and changes related to pandemics.

“We’ve seen many of our team members step up and learn new skills and functions in order to exceed on-time delivery expectations from our customers,” he says.

Levin says initially, the challenge was how to stay open and safely produce a product while following CDC guidelines to ensure employee safety at all times. They quickly found ways to innovate and control costs without letting people go or impacting their workforce.

“The most recent variant of the COVID virus has impacted the availability of our production workforce; however, team members from other departments, including sales, have stepped up to come to the manufacturing facilities and assist with powder production so we can continue to deliver on our mission of providing unparalleled service and product to the industry,” Levin says.

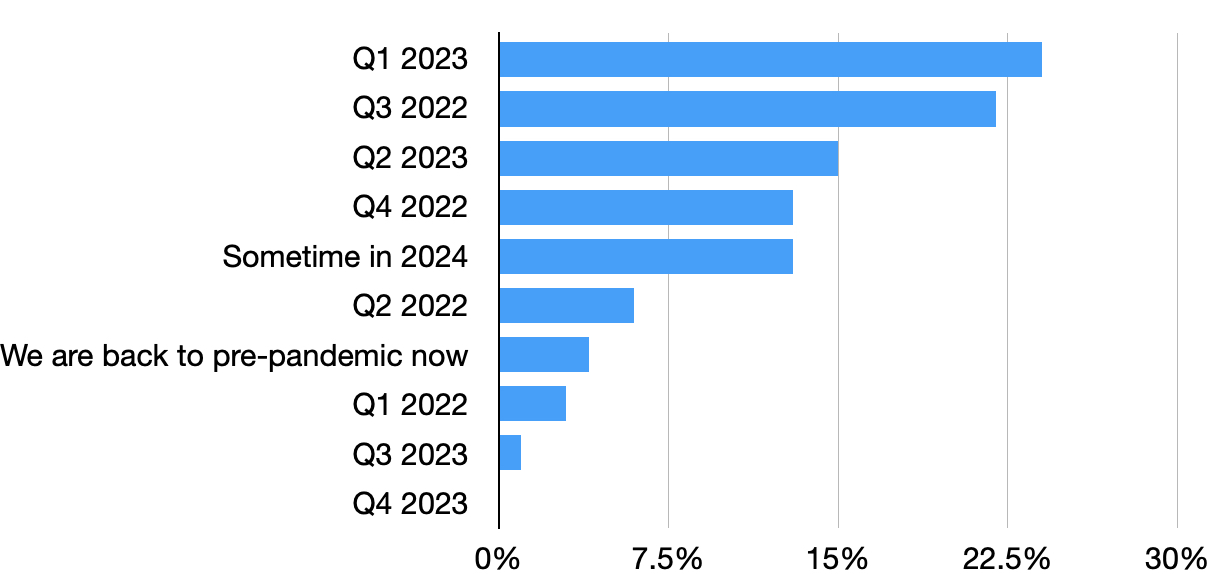

When finishing shops believe things will return to "normal."

When finishing shops believe things will return to "normal."

Keeping Supply Teams Together Through COVID

Pedral says MEIS was severely affected as it challenged them to keep teams together.

“Operationally, it forced us to seek for temporary employees, switch work shifts and hours, and ultimately increased our operational cost,” he says. “In addition, the several sanitary and medical measures implemented to support our employees have added to the overall cost of our operation. Lastly, by affecting our customers, it made an important impact in the ability to service them with the regularity and cadence we were used to, and that helped to prevent issues, and therefore becoming more reactive.”

Levin added that —aside from the flexibility of their workforce in enabling them to continue to produce powder — IFS Coatings have been creative in all sorts of different ways, from the obvious ones such as significantly increasing the use of virtual calls (“Webex is our new best friend,” she says) through making sure their customers have additional technical resources, including troubleshooting posters and guides and access to a hotline so they speak to a technical service rep if they can’t physically see one.

“Communication is also key,” Levin says. “Everyone is experiencing the same rapidly changing environment, so making sure we keep our customers informed as soon as we can is paramount.”

Rose says much of Hitachi’s business is conducted face-to-face, which has presented challenges in terms of getting product experts and service engineers on-site. Throughout the pandemic, they have worked closely with their customers to find ways to keep them running and get them the new instrumentation they need to run their business.

“Some of this involved creative scheduling, while other areas involved broader adoption of digital tools for remote support, demonstrations, and technical consultations,” Rose says.

Pedral says MEIS is expecting a return to supply chain normalcy close to Q4 2022, depending on the demand but mostly depending on potential new disruptions due to the pandemic.

“Containment, control, and overall availability of labor will be critical to the prevention of further supply chain issues,” he says.

Labor Force Returning To Normal

Hitachi’s Kreiner says it’s going to take time for the labor force to return to normal both in terms of staffing levels and attendance, and it may take longer to clear out order backlogs and overcome logistical capacity issues.

“After that, manufacturers are going to need to be convinced that the supply chain is predictable enough that they can better balance ordering incoming goods as needed and holding excess supply to avoid shortages,” he says. “The new normal is probably still 12-18 months away, and it will likely look substantially different to what it was pre-pandemic.”

Burningham adds it is difficult to predict what will happen with supply chain matters.

“But we’re projecting things will improve in Q3 2022 for many raw material categories,” he says.

Miles’ Zinman says there was a lot more optimism for 2022 until the omicron variant emerged.

“We are now hoping things stabilize by Q3 2022,” he says.

Pankow, meanwhile, doesn’t anticipate things will ever get back to normal, but they also don’t believe it will be like this forever.

“Somewhere in between,” he says. “We anticipate companies will implement contingency plans, keep more safety stock, approve multiple sources, focus on domestic partners, and much more.”

Levin says it’s been an interesting couple of years with cost increases, raw material availability issues, supply allocations, a global logistics crisis, and now inflation issues adding to the fray.

“All of these continue to significantly impact costs, and as yet, there has been no relief, nor sign of relief coming at this point,” she says.

To get a copy of this full survey and study, please contact Tim Pennington, Editor-in-Chief at tp@FinishingAndCoating.com