Suffice it to say, the lights were turned out on the majority of the work Aluminum Coil Anodizing Corporation performed for several decades.

Gary RuschWhen fluorescent light fixtures — of which ACA specialized in the anodized light reflectors — suddenly were being replaced by LED lighting that used less energy, they found their business dimming in front of their eyes. The fluorescent lights also contained some elements — including mercury — that led to an industry-wide change.

Gary RuschWhen fluorescent light fixtures — of which ACA specialized in the anodized light reflectors — suddenly were being replaced by LED lighting that used less energy, they found their business dimming in front of their eyes. The fluorescent lights also contained some elements — including mercury — that led to an industry-wide change.

The Streamwood, Illinois-based ACA quickly found the market they had been specializing in for nearly 50 years — the coiled aluminum reflectors — going dark on them.

“That probably made up maybe about 85% of everything that we produced here in the shop,” says Dave Christopher, ACA’s Director of Sales and Marketing. “Over the last 10 years, we’ve had to pivot on that because the lighting industry moved away from fluorescent lighting to LEDs. And when they moved to that LED lighting, there was really no need for the big reflectors on the backside to reflect that 360-degree fluorescent lighting that was up there.”

Maintaining Business in the Coiled Aluminum Anodizing Sector

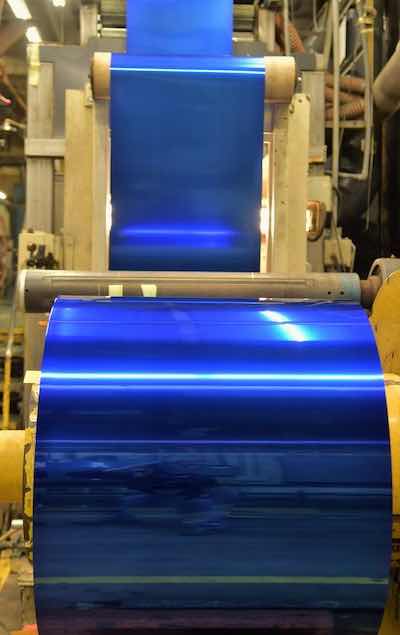

Aluminum Coil Anodizing Corporation specializes in architectural and automotive clients.That huge market switch forced Christopher and ACA President Gary Rusch to quickly look at the remaining 15% of the industries they were serving to see how they could maintain a business in the coiled aluminum anodizing sector.

Aluminum Coil Anodizing Corporation specializes in architectural and automotive clients.That huge market switch forced Christopher and ACA President Gary Rusch to quickly look at the remaining 15% of the industries they were serving to see how they could maintain a business in the coiled aluminum anodizing sector.

They had some architectural and automotive clients they had been working with, so they had a foot in the door. But the dramatic speed of the fluorescent lighting industry — coupled with governments all over the world who were starting to mandate the switch to LED — was breathtaking.

Alcoa was ACA’s largest customer at the time, as the aluminum manufacturer would ship large amounts of the coil to ACA to anodize and return, where they would then be shipped by Alcoa to lighting manufacturers all over the globe.

“Someone at Alcoa made a decision that they were to close that particular part of their business because they saw the whole lighting industry tanking,” Rusch says. “They gave us a customer list as well as a competitor list and said, ‘Here, have at it. You guys take these customers because we’re done. That severely impacted us.”

New Way of Doing Business

Not only did the loss of Alcoa hurt their bottom line, but Christopher says it also made ACA forge into areas that it often wasn’t used to, such as having to find wholesalers to buy the coils from and managing that process.

“It was their metal that we were bringing in, and we were mainly just processing it,” Christopher says. “And then when that switch happened, we had to start buying the metal and then processing it. And instead of just selling it as a toll product, it was sold as a package to the various end-use customers that were out there. That was a big change in itself, too.”

“When the whole industry fell apart, we had the challenge to fill that line with work,” Rusch says. “And we still struggle with that to some extent.”

Compounding the issue was that most of the machinery ACA used to anodize was set up for lighting sheets; while Rusch says the equipment was capable of running other materials, too, there were gauge and dying limitations.

“When the whole industry fell apart, we had the challenge to fill that line with work,” he says. “And we still struggle with that to some extent.”

But ACA has worked hard to refocus its work in areas where it can use its anodized coil coating expertise, Christopher says, and has increased their work in industries such as appliance, automotive, distribution, and architecture.

“I’d say our business is split up at about 20% to 25% in each of those industries,” he says. “We haven’t made up the volume, but you also have to look at it that we are now selling a lot of products on a package basis versus a toll basis. So the price of the metal now is in it, and from a revenue standpoint, we’re still not exactly where we were maybe 15 years ago, but we’ve built it up to be somewhat close to that.”

Focusing on the Automotive and Appliance Sector

ACA has increased its work in industries such as appliance, automotive, distribution, and architecture.ACA says it had to do a lot of work with introducing itself to manufacturers in the automotive and appliance sector, but Rusch and Christopher put a huge emphasis on getting to know the players and focusing on those markets.

ACA has increased its work in industries such as appliance, automotive, distribution, and architecture.ACA says it had to do a lot of work with introducing itself to manufacturers in the automotive and appliance sector, but Rusch and Christopher put a huge emphasis on getting to know the players and focusing on those markets.

“That took two to three years to finally start getting some consistent business with those markets rolling,” Christopher says. “With automotive, a couple of our customers are moving work from China back to the U.S., and that has given us some opportunities.”

On the appliance side, the major domestic appliance suppliers have become some of ACA’s main customers. Things slowed during the pandemic, but business has rebounded somewhat. ACA sources their aluminum from both the U.S. and Europe; with supply chain issues, the four-month lead time they were getting from Europe grew to six to seven months, but those times have improved, too.

Having that much lead time for raw materials does present its own problems, such as in forecasting what they will need almost six months out of when they will actually need it.

“We base it on history to a great extent, which is really the only thing we have,” Rusch says. “We don’t really have any other way to know. It can be risky at times, but Dave and his team have done a really good job of managing the inventory.”

Christopher says during the pandemic, it was very difficult trying to buy metal into the following year because they didn’t know what their customers were going be taking.

“Are they ramping up fully to 100%, or are they still shut down?” he says. “That became very difficult to manage through. You just try to do your best with how the orders are coming in historically and try to figure out what metal typically is being moved, and then make sure you have that in stock.”

Provide Continuous Coil Anodizing, Coil Processing, and Value-Added Services

ACA President Gary Rusch, left, and Dave Christopher, Director of Sales and Marketing say their trademarked UltraBond’s unique surface provides customers with a metal surface that maximizes adhesion.ACA provides numerous solutions for continuous coil anodizing, coil processing, and value-added services to enhance their customer’s metal applications:

ACA President Gary Rusch, left, and Dave Christopher, Director of Sales and Marketing say their trademarked UltraBond’s unique surface provides customers with a metal surface that maximizes adhesion.ACA provides numerous solutions for continuous coil anodizing, coil processing, and value-added services to enhance their customer’s metal applications:

- Lighting sheet: specular, texturized, matte, or embossed.

- Anodized foils: slit and cut blanks from 0.076 mm.

- Decorative metals: wide range of colors, finishes, and substrates.

- Interior and exterior architectural aluminum.

- Painted and coated products: reflective and clear lacquered.

- Chemical cleaning, etching, brightening, and laminating.

- Value-added slitting, blanking, protective coatings, embossing, and perforations.

ACA doesn’t look at itself as just a supplier of continuous coil anodizing; it has increased its value-added services to attract more business. Its lab matches a customer’s color and finishes designed for the end-use application and can anodize light gauge foils and precision slit widths as narrow as 0.59 inches (15 mm) and 7.87-inch blanks (200 mm).

“The anodizing process allows us to submerge the entire coil in a sulfuric acid solution to uniformly anodize the entire substrate,” Christopher says. “We can then coil it back up, sheet the coil, or slit the coil to whatever sizes our customer needs.”

Christopher says ACA can also manage to supply perforated, embossed, clear coated, and several coated/white-painted finishes in aluminum and steel for lighting and architectural applications. Its trademarked UltraBond’s unique surface provides customers with a metal surface that maximizes adhesion.

“One of the issues that the industry has in regards to perforated coils is that this material cannot be prepainted in coil form after it has been perforated,” Christopher says. “The final perforated parts need to go through a thorough post-paint process to uniformly paint/coat the metal surface and inside the cut edges of the perforated holes.”

He says one of the values that ACA brings is that they can manage to have the coils perforated at one of their local perforating partners to their customer’s design. They can then put the perforated coil through its anodizing line, and they are able to anodize the coil uniformly on the surface and inside the cut-edge holes of the perforations.

“The anodizing process allows us to submerge the entire coil in a sulfuric acid solution to uniformly anodize the entire substrate,” Christopher says. “We can then coil it back up, sheet the coil, or slit the coil to whatever sizes our customer needs.”

Becoming a More Creative Company

Rusch says that, while he wasn’t happy to see their fluorescent industry work almost disappear into thin air, the change in how they do business has forced them to be more analytical about where they can offer their unique anodizing services.

“It behooved us to make sure that we are more creative with our thinking so that we can find different markets,” he says. “We’ve had to learn how to do things that we didn’t think we’d be able to do, like anodizing super thin substrates. We’ve had to recreate some of our processes. It’s made us more diversified, certainly out of need. And sometimes that creates other positive aspects for your business as well.”

Visit https://acacorp.com