No finishing shop wants to shut down its line for five weeks, but for Steve Sedely and the team at LaPeer Plating and Plastic, it was well worth the wait.

Sedely, the Plating Manager at the LaPeer, Michigan, manufacturer, helped oversee a significant capital investment in their plating operation — a $3.8 million expansion of their capabilities to provide both trivalent and hexavalent chrome finishes on their plating line.

“It took over a year to plan how we were going to shut everything down for that long,” Sedely says. “Fortunately, it went as we planned it and we made it through.”

Line That Runs Trivalent and Hexavalent

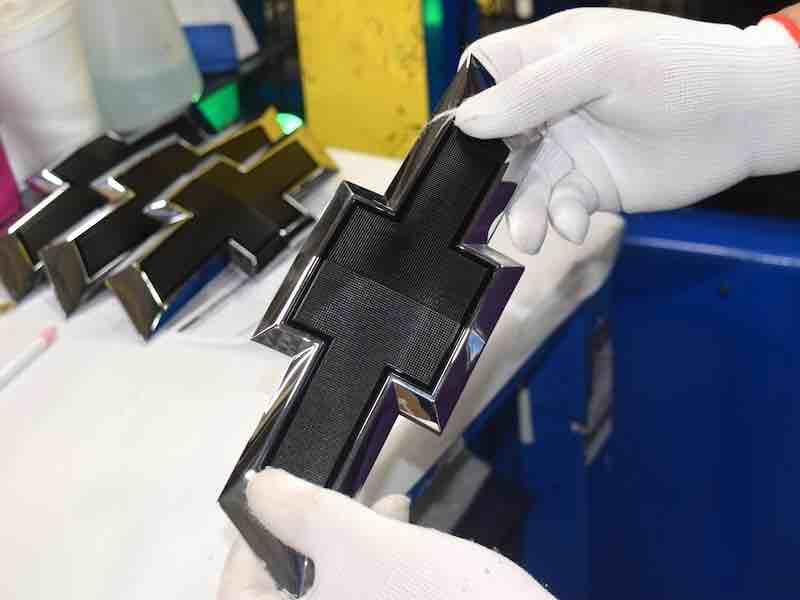

Lapeer Plating is a maker and finisher of Class A, high-visibility automotive components, including emblems and ornamentation.The result is a trivalent and hexavalent strategy that will provide LPP with the resources it needs to remain one of the top automotive manufacturers and finishers in North America.

Lapeer Plating is a maker and finisher of Class A, high-visibility automotive components, including emblems and ornamentation.The result is a trivalent and hexavalent strategy that will provide LPP with the resources it needs to remain one of the top automotive manufacturers and finishers in North America.

The company is a maker and finisher of Class A, high-visibility automotive components, including emblems and ornamentation, moldings and grilles, and decorative trims for major OEMs.

Doug Goad, Chief Executive Officer, says the multi-million dollar improvement project was at the request of one of LPP’s top customers, General Motors, which, like most major U.S. automotive OEMs, is trying to reduce the amount of hexavalent chrome it is using in its vehicles to be more environmentally friendly.

“It was driven by the customer, General Motors, as a requirement for a new program,” Goad says. “We have a large quantity of emblems on their own vehicles, and to compete for the new business, it required that we be able to provide a trivalent system, and that was where the decision was made. It was a significant capital investment analysis on behalf of the company to obtain the business from General Motors.”

“It started with GM, then Toyota has kind of followed, and Ford is moving in the same direction. All the North American OEMs are starting to fall one by one to trivalent chrome.”

Mike Hitch, Commercial Director for LPP, states that the word began circulating from GM in 2023 that they would require the change to trivalent for their suppliers.

”GM was the first OEM to officially mandate from their chrome suppliers that trivalent is the required finish versus hexavalent chrome,” he says. “When we started to see official requests in 2024 from GM for direct business and then some of our tier one customers, it was clear that this would be a requirement. But we've talked about adding trivalent chrome here for the last four years or so.”

Shutting Down Line for 5 Weeks

Michael HitchYet, because of the multi-million-dollar costs involved — and the required shutdown that would be needed to make the conversion — LPP leaders still had to think through the decision thoroughly before concluding to add trivalent.

Michael HitchYet, because of the multi-million-dollar costs involved — and the required shutdown that would be needed to make the conversion — LPP leaders still had to think through the decision thoroughly before concluding to add trivalent.

It was then that a decision had to be made on where to place the new line; LPP was limited in its expansion outside its current footprint, and they didn’t have a lot of open space inside their plant for such a massive project, either.

“There were a lot of discussions about what makes sense for our business, not only from a production standpoint, but from a cost standpoint,” Hitch says. “Given the fact that we have a plating line and we don't have enough room in the existing plant as it is with the current footprint, it was either building a new line and essentially add some sort of a pole barn or a structure, but it just didn't make sense. From a cost standpoint, it would've been significantly more expensive to have two separate lines.”

The overhaul included adding new tanks to the existing hex chrome line to hold trivalent baths.He says it would've been easier to implement with a new building because LPP was going to face a shutdown to revamp its current plating line. However, the thought that the hex chrome line might disappear in the future altogether made it an easier decision to overhaul the existing line and convert it into a dual-purpose operation.

The overhaul included adding new tanks to the existing hex chrome line to hold trivalent baths.He says it would've been easier to implement with a new building because LPP was going to face a shutdown to revamp its current plating line. However, the thought that the hex chrome line might disappear in the future altogether made it an easier decision to overhaul the existing line and convert it into a dual-purpose operation.

“Eventually, I think what we're going to see is this progression away from hex chrome to tri chrome,” Hitch says. “It started with GM, then Toyota has kind of followed, and Ford is moving in the same direction. All the North American OEMs are starting to fall one by one to trivalent chrome.”

The overhaul included adding new tanks to the existing hex chrome line to hold trivalent baths. Plumbing and electrical work were required to bring the lines into operation, and then new recipes were programmed into LPP’s enterprise resource planning system, which instructs the flight bars on which parts to insert into the hex or chrome baths.

Adding New Tanks, Anodes, and Rectifiers

In addition to new tanks, anodes for the sulfate-based baths, and rectifiers to operate the new system were also added.The major costs for the installation were incurred from adding the new tanks, anodes for the sulfate-based baths, and rectifiers to operate the new system.

In addition to new tanks, anodes for the sulfate-based baths, and rectifiers to operate the new system were also added.The major costs for the installation were incurred from adding the new tanks, anodes for the sulfate-based baths, and rectifiers to operate the new system.

“Multiple items increase the project’s cost. Additionally, you need scrubbers for emissions,” Sedely says. “The way they're classifying it, the emissions are similar to those of chrome. Because it is a new process, you still need to have a scrubber in place to remove the chrome mist. And we also added completely new storage tanks.”

The $3.8 million cost was not something that surprised the LPP team.

“With plating, everything is expensive,” Sedely says. “It’s all the way down to your labware. It just wasn’t a huge shock; we could take some costs down in negotiation, and we worked to bring them down on price, but it is still expensive.”

Hitch says that when the new work from GM arrives and they start running more trivalent parts, they will be close to running 50%-50% hex chrome and trivalent parts. It will also elevate LPP's status a few notches in terms of plating-on-plastic operations.

“The team did an amazing job of timing it out. This is an older facility, and the tear-up of the facility was massive; it unleashed dirt and contamination and all kinds of other factors you don’t normally have to deal with.”

“Lapeer Plating and Plastics will be the largest POP trivalent chrome manufacturer in North America,” he says. Chrome goes through cycles, and I think that right now, trivalent is certainly in demand and increasing year-over-year. We'll continue to see that, but every OEM has its preference as to chrome content and how they achieve certain looks on the vehicle, so it's OEM dependent.”

Planning to Not Plate Parts in Downtime

Ann ShellenbargerAside from designing and installing new components on the plating line to accommodate trivalent, the LPP team also had to plan for a period of almost five weeks during which they would be unable to plate parts.

Ann ShellenbargerAside from designing and installing new components on the plating line to accommodate trivalent, the LPP team also had to plan for a period of almost five weeks during which they would be unable to plate parts.

They tried to work ahead as much as possible, but there were still many anxious moments as the conversion date neared and they would have to shut down most of their finishing operations.

”The team put together a very robust plan aligned with our key customers,” Goad says. “We built ahead about five to six weeks’ worth of material. We put all that product in line, get it chrome, get it stored, and then we were able to keep the molding and assembly operations fed.”

Hitch says that when the new work from GM arrives and they start running more trivalent parts, they will be close to running 50%-50% hex chrome and trivalent parts.He adds that LPP came “within about three days of it being absolutely perfect” from a material availability standpoint. They made a slight adjustment to the schedule for one of their customers, who had a count issue that caused them a bit of a challenge when coming back online.

Hitch says that when the new work from GM arrives and they start running more trivalent parts, they will be close to running 50%-50% hex chrome and trivalent parts.He adds that LPP came “within about three days of it being absolutely perfect” from a material availability standpoint. They made a slight adjustment to the schedule for one of their customers, who had a count issue that caused them a bit of a challenge when coming back online.

“For the most part, the team did an amazing job of timing it out,” Goad says. “This is an older facility, and the tear-up of the facility was massive; it unleashed dirt and contamination and all kinds of other factors you don’t normally have to deal with. But Steve and the chrome team —when they brought it back online on September 8 — the first parts out of the gate were good.”

Ann Shellenbarger, LPP’s Chief Financial Officer, says they performed numerous preparatory tasks related to customer communications, such as notifying them to prioritize their orders ahead of when the lines would go dark.

“In our production planning, we obviously did pre-built inventory running ahead on volumes and long lead items,” she says. “We looked at what could be critical during the shutdown, and then staggering or spreading it over the increases over the weeks leading up to the shutdown to avoid overwhelming capacity.”

Good Supplier Coordination Was Key

Plumbing and electrical work were required to bring the lines into operation, and then new recipes were programmed into LPP’s enterprise resource planning system.Shellenbarger says they also had good supplier coordination and informed their suppliers about the reduction in demand to avoid excess deliveries during the downtime. The downtime of the plating line was also a good opportunity to plan for other jobs that needed to be done around the facility.

Plumbing and electrical work were required to bring the lines into operation, and then new recipes were programmed into LPP’s enterprise resource planning system.Shellenbarger says they also had good supplier coordination and informed their suppliers about the reduction in demand to avoid excess deliveries during the downtime. The downtime of the plating line was also a good opportunity to plan for other jobs that needed to be done around the facility.

“Our maintenance, also during this time, was doing what they could do for a deep maintenance, any preventative work, and predictive work for equipment that needed to be done during that time,” she says. “We were capitalizing on capital improvements for the downtime, so production impact would be minimized when we got back up and running.”

They also had to work with their team members who might be affected during the line shutdown. Shellenbarger says they let the staff know well ahead of time in case they need to coordinate any off-team while the work inside the plant is stopped.

“We worked with the team on any paid leave vacations, making reduction shifts, and communicating effectively,” she says. “We also were cross-training our team for different opportunities during the shutdown to upskill our employees where we needed to.”

On the financial side, LPP had to accommodate the fact that there was little production to bill for during the new installation and shutdown. They had been planning continuously since February for the shutdown, which was scheduled to take effect in August.

“There were a lot of bench tests leading up to this. But to have that added safety net of having an additional sourcing just for this running into that possible scenario, that's what we did.”

“From a financial perspective, cash flows the forecast of these build-ahead advances from expense management,” Shellenbarger says. “Any financial levers, we had to manage appropriately. And, of course, revenue smoothing in that eventuality. We were also in line with our budget to ensure that everything was executed accordingly. The team did a phenomenal job and had good communication with all the shareholders involved.”

Adapting to Running a Trivalent Line

The downtime of the plating line was also a good opportunity to plan for other jobs that needed to be done around the facility.Sedely’s team didn’t have that much trouble adapting to running a trivalent line when it went online. They had previously received some training and had worked with their supplier on any special details associated with running trivalent parts.

The downtime of the plating line was also a good opportunity to plan for other jobs that needed to be done around the facility.Sedely’s team didn’t have that much trouble adapting to running a trivalent line when it went online. They had previously received some training and had worked with their supplier on any special details associated with running trivalent parts.

“The analogy we used is that it's basically a blend between running an electroless copper and a nickel bath,” he says. “There are some technical, needy systems within it, like the e-copper, but it's also like a nickel bath where you can run it and clean it and keep it processed just like a nickel.”

The LPP team also had to adjust their wastewater treatment system to accommodate the trivalent, which tends to be much harsher on systems than its hexavalent counterpart.

“Some say there is no issue and they mix it right with their general waste stream, and the other side says they have issues with the chelators within it,” Sedely says. “What I did to protect us is put a waste storage tank just for trivalent, where I can have it go to our general waste holding tanks, or I can go to its own specific trivalent storage tank. The trivalent system is located in its own secondary containment pad, ensuring it's not mixed with any other chemicals. I can pump to either side.”

“This was the right choice for Lapeer. The reality is GM is our largest customer, and so when your largest customer makes a change — or a mandate — that impacts you, then certainly you have to discuss as a business unit and make a business decision.”

LPP has been conducting extensive bench testing to optimize the trivalent process for waste treatment, aiming to reduce allowable levels below the recommended levels and assess its reaction with nickel, copper, and hex chrome.

“There were a lot of bench tests leading up to this,” Sedely says. “But to have that added safety net of having an additional sourcing just for this running into that possible scenario, that's what we did.”

Discussions with Other OEMs Taking Place

Hitch says Lapeer Plating and Plastics will be the largest POP trivalent chrome manufacturer in North America.Hitch says that, with the new trivalent line in, he has already had discussions with other OEMs about taking on their work, even from the commercial truck world.

Hitch says Lapeer Plating and Plastics will be the largest POP trivalent chrome manufacturer in North America.Hitch says that, with the new trivalent line in, he has already had discussions with other OEMs about taking on their work, even from the commercial truck world.

“International, one of the top OEM truck manufacturers, is taking a real hard look and a close look at this same type of mandate of changing from hexavalent to tri,” he says.

“This was the right choice for Lapeer,” Goad says. “ The reality is GM is our largest customer, and so when your largest customer makes a change — or a mandate — that impacts you, then certainly you have to discuss as a business unit and make a business decision. And knowing that at the OEM level, this is the migration from hex to tri, and it is only going to continue. I absolutely think this will create growth for Lapeer as an organization.”

He believes that, from an industry standpoint, beginning now and over the next decade, nearly every OEM will strive to eliminate hexavalent wherever possible.

“Being at the leading edge of that, it allows us to command a little bit better position,” he says.

Visit https://lpp-inc.com.