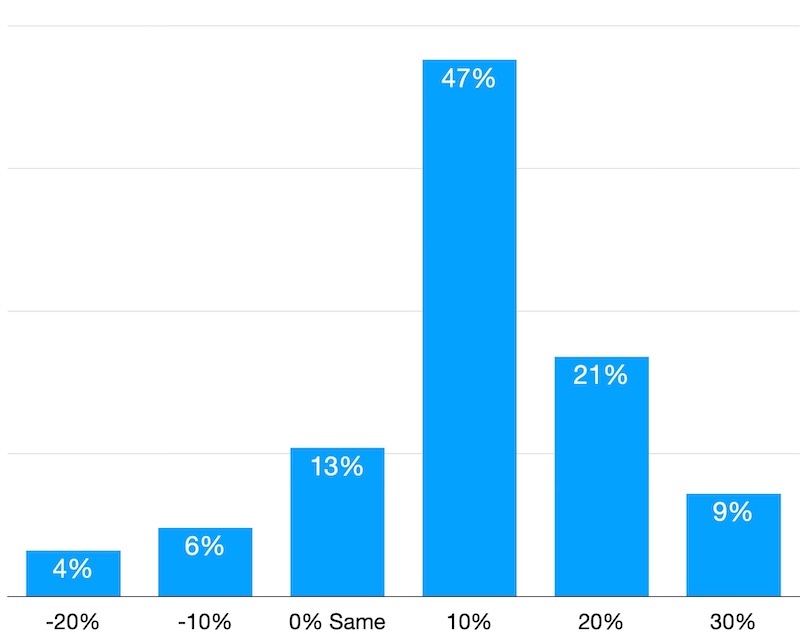

Nearly half of finishers and coaters believe that 2026 will only be slightly better than 2025, when many shop owners saw a drastic downturn in business in North America.

In a survey of several hundred shops conducted by www.FinishingAndCoating.com, 60% of shop owners or presidents expect a modest uptick in business in 2026, at least 10% above 2025 numbers.

About 30% of shops report forecasting revenue increases of 20% or more, while about one-fourth (23%) expect business to be stagnant or down from 2025 levels.

Finishers cited a wide range of causes for the decline, but many presidents and owners cited the lagging economy.

“The beginning of the year was a bit slow, but we saw an immediate demand increase in Q2 from our defense industry manufacturers.”

“It was economic conditions, inflation, the impact of tariffs, and a lack of direction from automakers on EV vehicles,” says one Michigan shop owner. “And the cost of living has gone up.”

The survey was conducted with over 1,200 shops in North America in early December; only those shops that completed the survey will receive the full results.

2025 Not Healthy for Many Shops

About 37% of shops say business was down 10% or more from 2024 numbers.The past year was dreadful for many shop owners and managers, with about 37% saying business was down 10% or more from 2024 numbers. Many more say no growth at all despite seeing rising operating costs.

About 37% of shops say business was down 10% or more from 2024 numbers.The past year was dreadful for many shop owners and managers, with about 37% saying business was down 10% or more from 2024 numbers. Many more say no growth at all despite seeing rising operating costs.

- 13% say business was stagnant and did not grow in 2025

- 22% say their business was down by 10% or more from a year ago.

- 15% report a 20% or greater drop in business since 2024.

While some shops lost customers entirely — one lost its top three customers in 2025 — many owners say the uncertainty from 2024 continued into 2025 and never improved as promised, even after a new administration was elected that promised to spark the U.S. economy.

“Interest rates are high, and that means new and used vehicles are not selling,” says one shop owner who is heavy in the automotive industry.

Another shop president added: “I believe the tariffs and political uncertainty led to some of the flat line in business. We did see an uptick in our military work.”

Of the shops that did see increases, the numbers were sufficient. Still, they didn’t always keep up with rising costs of running their operations, including chemicals, electricity, and water.

- 28% say they expect at least a 10% increase in business in 2025.

- 17% report revenue increases of at least 20%.

- 4% saw their business jump by up to 30% year-over-year.

“The beginning of the year was a bit slow, but we saw an immediate demand increase in Q2 from our defense industry manufacturers,” a manager of a West Coast plating operation said.

And the East Coast plating operations president says their shop spent much more time in 2025 developing new customer relationships and visiting manufacturing expos to speak with potential customers.

“We spent more effort in reaching out to new customers,” the owner says. “We went to trade shows in which we exhibited and walked the floor.”

“We increased sales revenue on expanded and refurbished lines of business, which was a good return on capital expenditures from 2023 to 2024.”

And in a throwback to the 1980s and 1990s, some shops report losing business to overseas competitors.

“Our sales amazingly stayed flat despite significant turmoil in our production mix,” a Midwest shop owner says. “This year we lost two of our largest jobs to Thailand-based competitors, and we cut down to 3-4 production days per week due to decreased demand.”

They say a few new small programs filled the gaps, though, as they “leap-frogged” through the higher mix.

“High volume accounts stayed mostly subdued,” they say. “OEM customers across the board shared that demand was the cause for their reduced sales and orders throughout the year.”

Looking to 2026: Hope on the Horizon

Around 77% of shops expect a 10% or greater increase in business in 2026.Overall, around 77% of shops expect a 10% or greater increase in business in 2026. The majority expect a 10% or greater increase; 21% expect at least a 20% increase, and 9% expect at least a 30% increase in business.

Around 77% of shops expect a 10% or greater increase in business in 2026.Overall, around 77% of shops expect a 10% or greater increase in business in 2026. The majority expect a 10% or greater increase; 21% expect at least a 20% increase, and 9% expect at least a 30% increase in business.

“We have some new customers and increased sales from some current customers,” a shop owner says. “Also, our team is doing an amazing job on throughput with orders.”

One Midwest shop reports spending in 2024 to improve its processes to prepare for 2025 and saw a 20% increase in business over the prior year.

“It was a further penetration of our long-term customer base and organic growth,” the owner says. “We increased sales revenue on expanded and refurbished lines of business, which was a good return on capital expenditures from 2023 to 2024.”

Cap Ex for Upcoming Year Rises

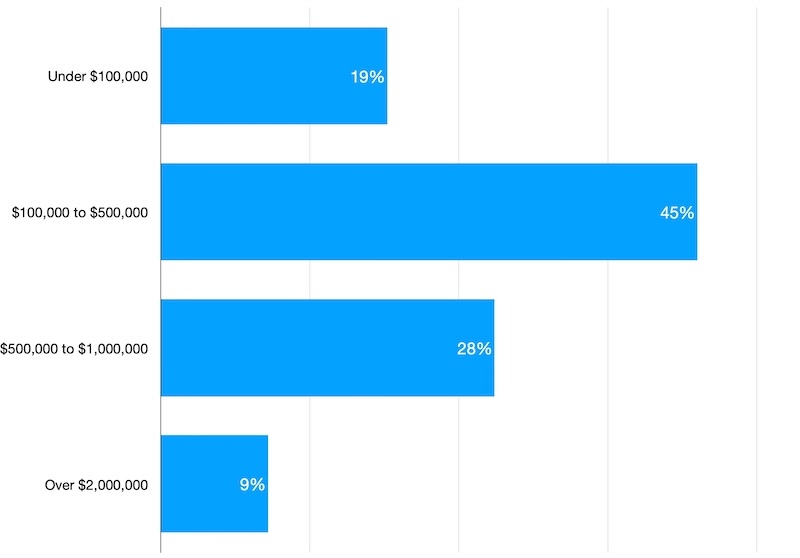

About 45% of respondents report budgeting up to $500,000 for capital expenditures in the coming year. Over 28% say they will spend more than $1,000,000 on new equipment and infrastructure in 2026, and 9% say their 2026 budget exceeds $2,000,000.

About 19% estimate they will spend under $100,000 on new equipment and facility upkeep.

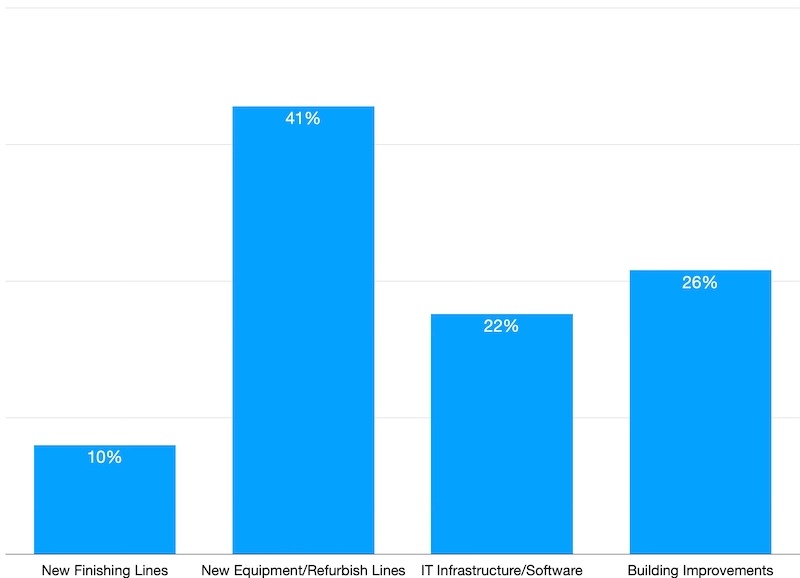

About 41% of shops plan to add new equipment or refurbish their existing lines. Approximately 10% of shops plan to add new lines. Building and infrastructure improvements are on the list for 26% of shop owners and managers, and IT and software upgrades are planned by about 23% of shops.

Biggest Concerns and Growing Trends

About 45% of respondents report budgeting up to $500,000 for capital expenditures in the coming year.Three items topped the list of the biggest concerns for finishers and coaters going into 2026: the economy, changes in the finishing industry, and growing regulations.

About 45% of respondents report budgeting up to $500,000 for capital expenditures in the coming year.Three items topped the list of the biggest concerns for finishers and coaters going into 2026: the economy, changes in the finishing industry, and growing regulations.

Some shop owners say that although the administration's tariffs will not directly hit them, the issue will have a residual effect on their businesses.

“It is not how the tariffs will affect us directly, but how they will affect the metal fabrication and manufacturing in general,” one shop president said.

The owners and presidents voiced other major concerns:

- “Downward pricing pressure even with steady inflation.”

- “Reduction in decorative finishing in the automotive industry.”

- “The increased cost of doing business, lack of skilled workers, and an unpredictable economy.”

One shop president said the labor issue is the industry's top concern.

“It’s labor, labor, labor,” the CEO says. “Finding good, reliable labor is not easy. It seems we are always looking to fill 4 to 5 positions. The finishing industry is a strong sector to work in and can provide long-term employment. When we find the right people, we definitely take care of them as they are difficult to replace.”

An owner of a large Midwest powder-coating operation expressed concern about the industry getting on board with the architectural industry to help grow that sector.

About 41% of shops plan to add new equipment or refurbish their existing lines.“The architectural market is still reluctant to use powder coat as compared to the overall market’s feelings regarding liquid coatings,” the CEO says. “It would benefit all architectural coaters that run powder lines if the viewpoint on powder coatings were to shift to bring architectural powder in line with architectural liquid.”

About 41% of shops plan to add new equipment or refurbish their existing lines.“The architectural market is still reluctant to use powder coat as compared to the overall market’s feelings regarding liquid coatings,” the CEO says. “It would benefit all architectural coaters that run powder lines if the viewpoint on powder coatings were to shift to bring architectural powder in line with architectural liquid.”

A major trend shop owners are seeing is consolidation among family-owned and privately held shops, which are being acquired by larger investment groups and finishing companies.

“The private equity groups are buying up the industry and putting pressure on all the small business owners,” one finishing president says. “It results in higher transactional relationships and less focus on relationships.”

Another trend shops are seeing is the growing number of agencies seeking to regulate the metal finishing industry, in addition to the U.S. Environmental Protection Agency.

“We are seeing many new regulators in different segments who have no idea what they should be regulating,” a shop president said.

The pressure from OEMs on shops to add trivalent chromium capabilities is also top of mind for some shops that are forced to bear the brunt of costs—sometimes in the multi-million-dollar range—to add trivalent processes.

“The switch from hex to trivalent chrome is difficult due to the slow changeover, which causes added expense to run both instead of everyone getting on board with one or the other at once,” a shop manager said.